SMATS Protected US Growth Fund Hedged.

Investing In High Quality US Growth Shares With Downside Protection And Currency Hedged To Australian Dollars.

Invested In Growth And Protection.

347 Darling Pty Ltd, ABN 38 604 854 999, AFSL 491106, a Licensee and Trustee wholly owned by SMATS Services (Australia) Pty Ltd, is pleased to offer the SMATS Protected US Growth Fund Hedged, a share fund focusing on growth, while using our proprietary downside protection strategy.

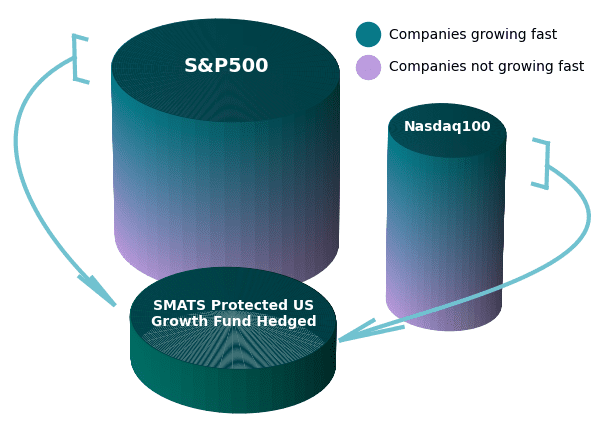

The objective of The Fund is to identify and invest in growth opportunities in the S&P 500 and Nasdaq 100 indices.

The Fund invests in a mix of 45% Nasdaq 100-listed companies, 45% S&P 500-listed companies, and 10% in the downside protection strategy.

Aim.

- Targeted returns at or above the benchmark indices (Nasdaq 100/S&P 500)

- Lower drawdowns in market value than the benchmark indices

- Better risk-adjusted returns profile than the benchmark indices

- Trade in only highly liquid shares in the US indices

- Weekly liquidity in normal market conditions

Key Features.

Trustee

347 Darling Pty Ltd, ABN 38 604 854 999, AFSL 491106

Investment Manager

SMATS Asset Management Pty Ltd, ABN 99 659 315 554

Target Fund Size

AUD $1bn

Minimum Initial Investment

AUD $50,000

Investor Type

Wholesale clients

Fund Term

Open-ended

Management Fee*

0.5% p.a. on funds under management (calculated daily, paid quarterly)

Performance Fee*

6% of net capital gains (i.e. gains excluding dividends and management fee)

Bid/Offer Spread

0.25% per subscription/redemption amount (based on estimated transaction cost of 0.25%)

Fund Currency

Australian dollars

Distributions

Distributions paid quarterly

Unit Pricing

On a weekly basis, published weekly

Protection Strategy Fee*

An allocation will be made to units in a downside protection fund, the “SMATS DM Protection Hedging Fund” (SDMPHF). Management Fee: 0.5% p.a. on funds under management (calculated daily, paid quarterly) and Performance Fee: 6% of net capital gains (i.e gains excluding management fee)

Redemptions

Available weekly, in normal market conditions, as outlined in The Fund’s Information Memorandum

*All fees and expenses are quoted exclusive of GST.

Strategy.

The Fund will apply a rigorous screening methodology to a pool of selected shares from the indices, with greater focus on the larger companies by market cap. The Fund will then screen for growth opportunities using the following 4 factors:

- Growth in earnings per share

- Growth in sales per share

- Price to earnings ratio

- Share price momentum

Using the above criteria, The Fund will create a growth score for each company. This growth score, along with a market capitalisation score (i.e. size of company), will result in an overall blended score, which will serve as the basis for stock selection for The Fund. The Fund will only consider those candidates with the highest overall blended score.

Wholesale or accredited investors can obtain a copy of the Information Memorandum by contacting us.

Comparison of Share Holdings.

Comparison of Annualised Return & Risk for 10 years (backtested).

Investment Objective.

Achieve targeted returns at or above the benchmark indices (Nasdaq 100/S&P 500).

The Fund will invest in listed US equities on S&P 500 and Nasdaq 100 indices. Our low turnover approach to investment is facilitated by protecting against downside market moves with the use of volatility, currency and government bond securities. It will not be trading short positions in shares. A strict and consistent proprietary investment process will be applied by SMATS Asset Management Pty Ltd in both selecting securities and selecting the weights for those securities.

We welcome your participation and further enquiry by submitting your details here.

Further information and a copy of the Information Memorandum is available upon registering your interest.

Register your interest.

Portfolio Construction.

Limit exposure to each company thereby reducing concentration risk. Maintain a low turnover in share trading by employing a downside protection strategy.

Top 10 Current Holdings

| Top 10 Current Holdings | % as at 25 Mar 2025 |

|---|---|

| Alphabet Inc | 8.56 |

| NVIDIA Corporation | 7.19 |

| Meta Platforms | 4.74 |

| Amazon.com Inc | 3.5 |

| Microsoft Corporation | 3.23 |

| Broadcom Inc | 2.72 |

| Netflix Inc | 2.66 |

| Palantir Technologies | 2.29 |

| Booking Holdings | 2.2 |

| Tesla Inc | 2.18 |